Contents

- Overview

- 1. Market Scale & User Engagement

- 2. The Creator Economy: Sugarbook Live

- 3. Sugar Daddy Profiles: Wealth Sources & Relationship Goals

- 4. Sugar Baby Demographics: The Rise of the Student Sugar Baby

- 5. The Sugar Economy: Allowances & Spending Trends

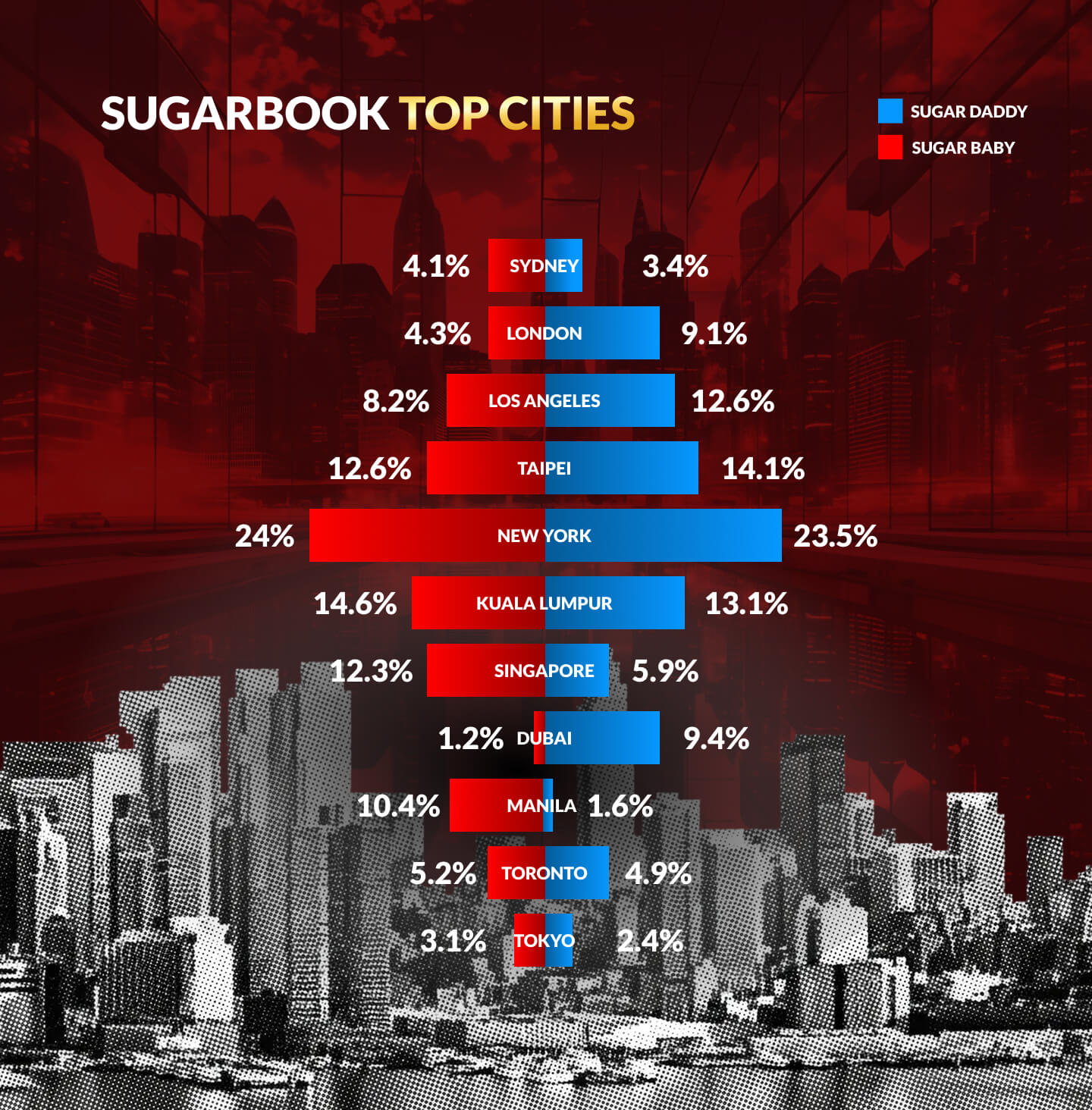

- 6. Geographic Trends: Top Sugar Dating Cities

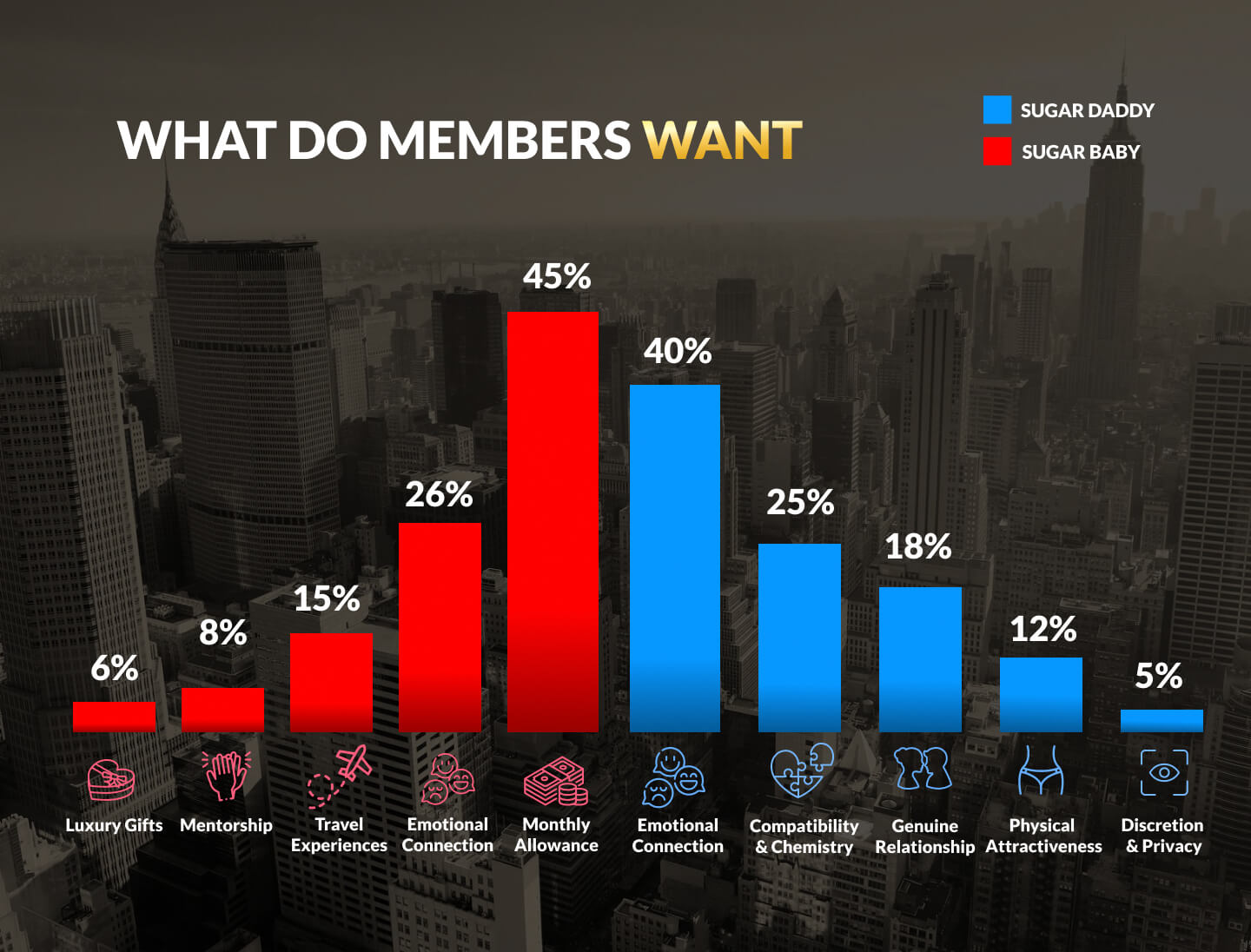

- 7. Relationship Intent: What Members Truly Want in 2025

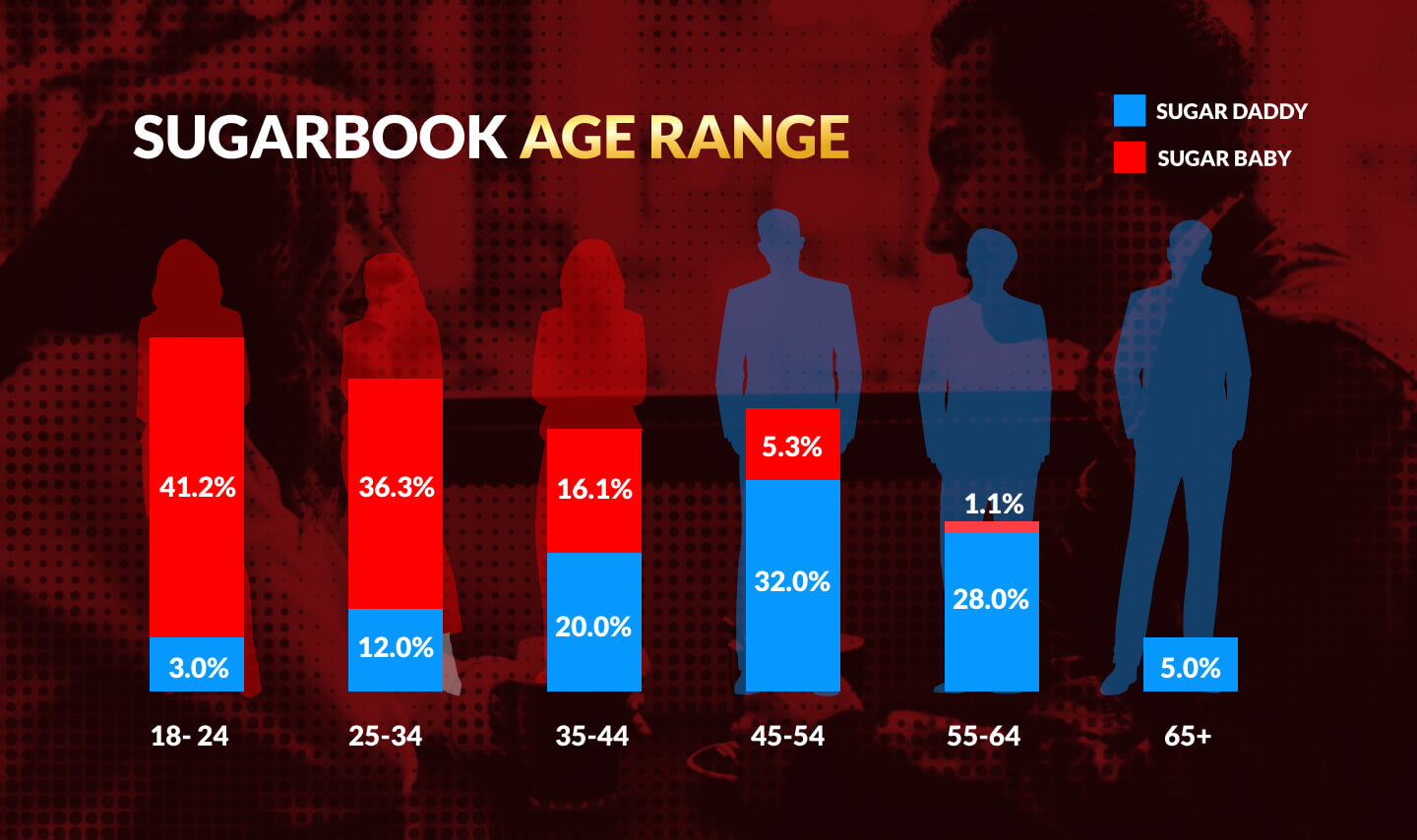

- 8. Age Demographics

- Conclusion & Future Outlook

- Key Takeaways from the Sugarbook 2025 Trend Report

- Which Sugar Dating Platform Is the Best in 2026?

- Frequently Asked Questions

Overview

The socio-economic landscape of 2025 has fundamentally altered how modern relationships are formed and maintained. As global inflation impacts the cost of living and digital intimacy becomes standard, niche dating platforms are no longer fringe anomalies but central players in the relationship economy.

The Sugarbook Trend Report 2025 analyzes data from millions of active users to reveal a distinct shift toward hypergamy and supportive relationships built on clear expectations. This year’s findings suggest that sugar dating is evolving from a lifestyle choice into a strategic financial and romantic solution for both parties.

For Sugar Babies, motivation has shifted from luxury acquisition to economic stability – particularly housing and education. Conversely, Sugar Daddies are increasingly seeking emotional intelligence and genuine companionship over purely transactional encounters.

Below is the comprehensive breakdown of the 2025 sugar dating industry on the leading sugar daddy dating platform.

TL;DR – Sugarbook 2025 Insights

- Sugarbook now operates in 143 countries with over 6.3 million combined Sugar Daddies and Sugar Babies.

- The average monthly allowance is $3,200 USD, with the highest reported monthly allowance reaching $150,000 USD.

- Student Sugar Babies (38%) dominate the platform, reflecting a generation balancing education with structured financial support.

- 40% of Sugar Daddies prioritize emotional connection, signaling a shift toward intentional and meaningful companionship.

- New York remains the global capital of sugar dating, while Kuala Lumpur and Taipei continue strengthening Asia-Pacific’s presence.

1. Market Scale & User Engagement

The 2025 data confirms that sugar dating is no longer niche, it is a structured and rapidly expanding global relationship economy. Strong user growth and high engagement levels reflect increasing demand for clear, intentional arrangements built on transparency and defined expectations.

- Total Members: Over 2.5M+ Sugar Daddies and 3.8M+ Sugar Babies worldwide.

- Platform Activity: More than 107M+ messages exchanged in 2025 alone, signaling strong retention and ongoing engagement.

- Average Monthly Allowance: $USD 3.2K, reflecting structured financial expectations.

- Highest Reported Monthly Allowance: $USD 150K, highlighting upper-tier earning potential within premium arrangements.

Key Insight: The scale of communication and financial transparency demonstrates that modern sugar dating is increasingly defined by structure, clarity, and economic alignment – not secrecy.

Sugarbook 2025 Milestones Report highlighting growth in verified sugar daddies, sugar babies, message activity, and real monthly allowance trends across the global sugar dating platform.

2. The Creator Economy: Sugarbook Live

The integration of live streaming has created a hybrid model of social dating and content monetization. 2025 saw significant revenue generation for creators on the platform, reflecting broader growth across modern sugar dating apps globally.

-

- Total Creator Payouts: Livestreamers earned over $1.2 Million USD.

- Top Content Creators: Led by streamers Nissy (40M diamonds earned), YanYan (23M diamonds earned), and Bombshell (16M diamonds earned).

Sugarbook Live 2025: Total livestreamer payouts exceeding USD 1.2 million, highlighting top sugar baby livestreamers and diamond earnings rankings.

3. Sugar Daddy Profiles: Wealth Sources & Relationship Goals

The stereotype of the elderly, married sponsor no longer reflects the reality of sugar dating in 2025. Today’s Sugar Daddies are more likely to be independent professionals who turn to sugar dating in search of clarity, compatibility, and meaningful connection often unmet on traditional dating platforms.

Wealth among Sugar Daddies is predominantly self-made, reflecting leadership, professional success, and financial independence. These trends align with the rise of successful sugar daddy profiles who prioritize independence and clarity.

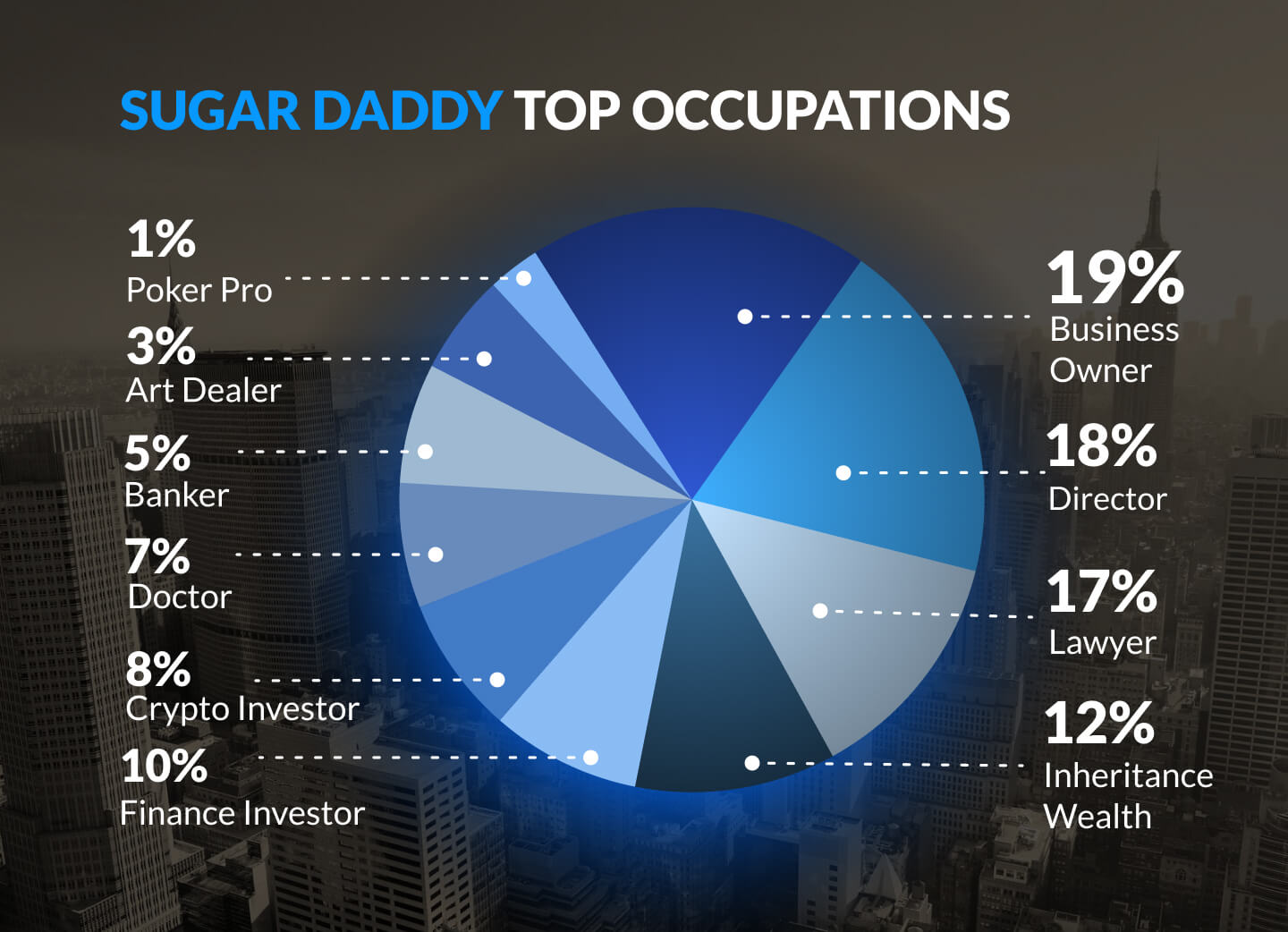

Wealth Sources

- 19% Business Owner

- 18% Direct

- 17% Lawyer

- 12% Inheritance Wealth

- 10% Finance Investor

- 8% Crypto Investor

- 7% Doctor

- 5% Banker

- 3% Art Dealer

- 1% Poker Pro

Sugarbook 2025 Insights: Top occupations of sugar daddies including business owners, directors, lawyers, finance investors, and high-net-worth professionals across the global sugar dating platform.

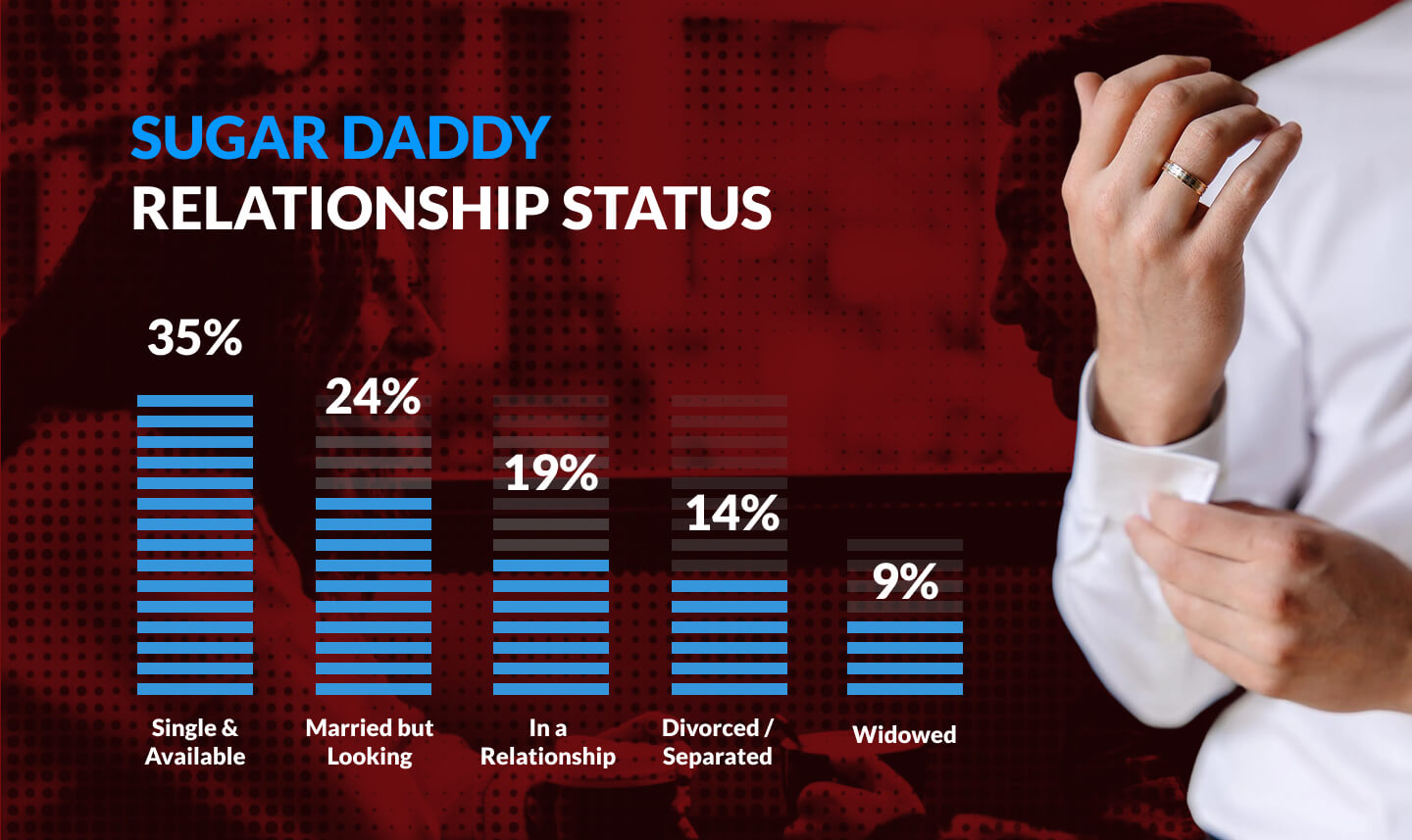

Marital Status

In 2025, Sugar Daddies are predominantly unattached, reflecting a clear shift toward independence and intentional dating rather than secrecy.

- 35% Single & Available (largest segment)

- 24% Married but Looking

- 19% In a Relationship

- 14% Divorced / Separated

- 9% Widowed

Sugarbook 2025 Insights: Breakdown of sugar daddy relationship status trends, highlighting single, married, divorced, and relationship dynamics within real sugar dating.

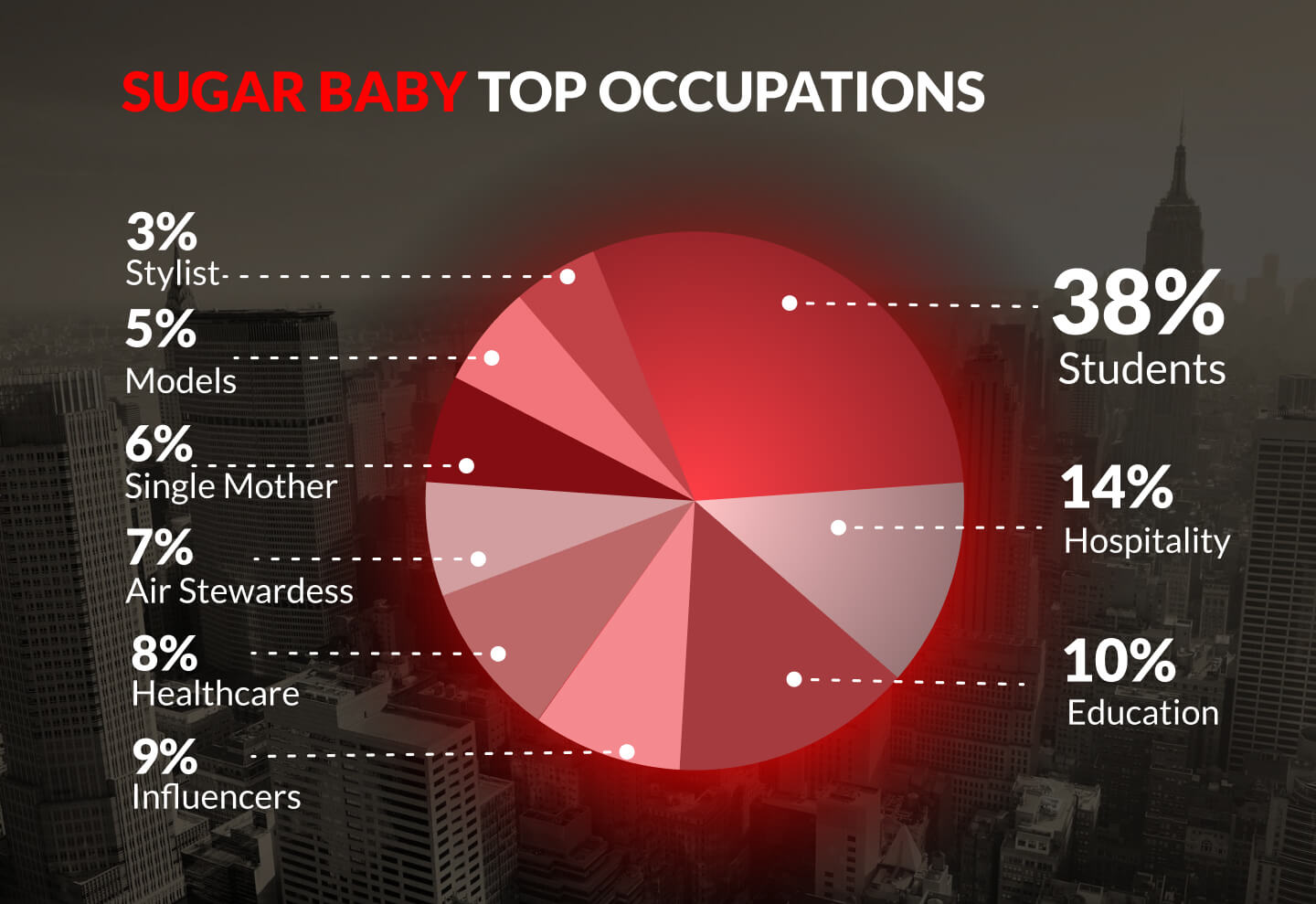

4. Sugar Baby Demographics: The Rise of the Student Sugar Baby

The demographic profile of the Sugar Baby remains young and educated, with a clear dominance of university students utilizing the platform to graduate debt-free. Many are actively researching how to become a sugar baby in 2026 as financial pressures increase.

Primary Occupations

- Student Sugar Babies: 38% (Market Leader)

- Hospitality Professionals: 14%

- Education: 10%

- Influencers: 9%

- Healthcare: 8%

- Air Stewardess: 7%

- Single Mother: 6%

- Models: 5%

- Stylist: 3%

Sugarbook 2025 Insights: Top occupations of sugar babies including students, hospitality professionals, educators, healthcare workers, influencers, and models across the global sugar dating platform.

5. The Sugar Economy: Allowances & Spending Trends

Search data frequently queries the “cost” of a sugar relationship. The 2025 financial data dispels the myth of frivolous spending; instead, it points to a pragmatic “survival economy” where allowances function as essential income supplements.

- Average Sugar Baby Allowance: The global monthly average is $6,500 USD. This aligns closely with our detailed

sugar baby allowance guide,

which breaks down realistic expectations for modern arrangements. - Ultra-High Net Worth (UHNW) Activity: The top percentile of relationships recorded allowances peaking at $150,000 USD per month.

- Allowance Allocation: How do Sugar Babies spend their money?

- 43% on Rent or Housing (Primary expenditure).

- 20% on Education Fee.

- 17% on Debt Repayment.

- 12% on Savings or Investment.

- 6% on Luxury Items

Market Insight: With 80% of funds allocated to Rent, Education, and Debt, the data confirms that sugar dating is serving as an economic safety net for young professionals and students rather than a gateway to luxury retail.

Sugarbook 2025 Insights: Breakdown of sugar baby spending behavior, highlighting how allowance support is used for housing, education fees, debt repayment, savings, and lifestyle expenses.

6. Geographic Trends: Top Sugar Dating Cities

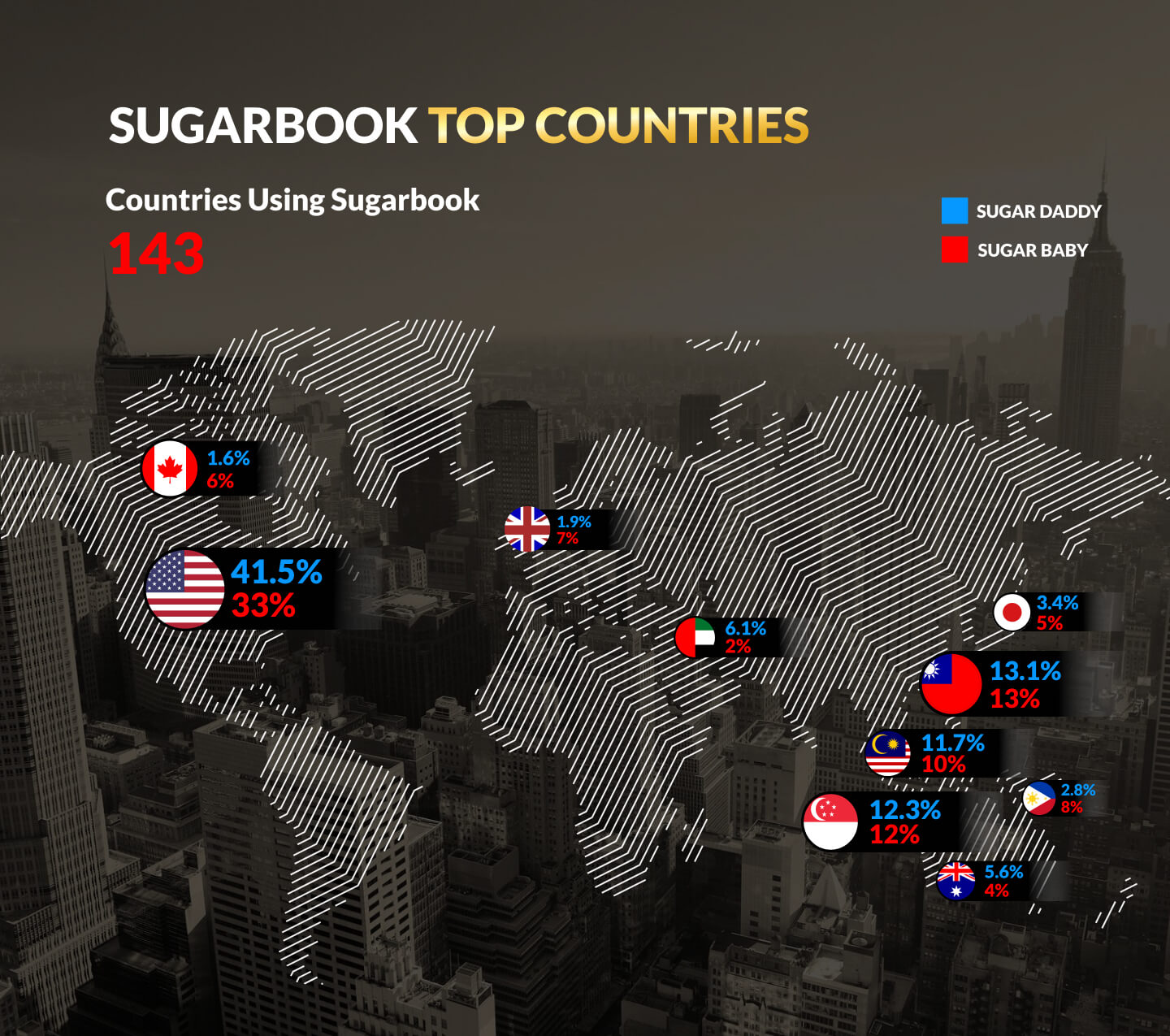

While the United States retains the largest market share—driven by strong demand for sugar daddy USA searches the APAC region (Asia-Pacific) is the fastest-growing hub for sugar dating.

- Global Footprint: Sugarbook has expanded its operational presence to 143 countries, validating the global demand for transparent relationship models.

Top Countries by User Density

- For Sugar Daddies:

- USA: 41.5%

- Taiwan: 13.1%

- Singapore: 12.3%

- Malaysia: 11.7%

- Philippines: 2.8%

- United Kingdom: 1.9%

- Japan: 3.4%

- United Arab Emirates: 6.1%

- Australia: 5.6%

- Canada: 1.6%

- For Sugar Babies:

- USA: 33%

- Taiwan: 13%

- Singapore: 12%

- Malaysia: 10%

- Philippines: 8%

- United Kingdom: 7%

- Japan: 5%

- United Arab Emirates: 2%

- Australia: 4%

- Canada: 6%

Sugarbook 2025 Insights: Top countries using Sugarbook, highlighting global sugar daddy and sugar baby growth across 143 countries worldwide.

The 2025 Sugar City Index

While New York City remains the undisputed global capital of sugar dating, supported by sustained demand for online sugar dating in New York the 2025 data reveals a significant power shift toward Asia. Kuala Lumpur, Taipei, and Singapore have emerged as major hubs, rivaling and in some cases surpassing traditional Western hotspots like London and Los Angeles.

Below is the definitive ranking of the top 10 cities for 2025.

Top Cities for Sugar Daddies

- New York – 23.5%

- Taipei – 14.1%

- Kuala Lumpur – 13.1%

- Los Angeles – 12.6%

- Dubai – 9.4%

- London – 9.1%

- Singapore – 5.9%

- Toronto – 4.9%

- Sydney – 3.4%

- Tokyo – 2.4%

Top Cities for Sugar Babies

- New York – 24%

- Kuala Lumpur – 14.6%

- Taipei – 12.6%

- Singapore – 12.3%

- Manila – 10.4%

- Los Angeles – 8.2%

- Toronto – 5.2%

- London – 4.3%

- Sydney – 4.1%

- Tokyo – 3.1%

Sugarbook 2025 Insights: Top global cities for sugar daddies and sugar babies, highlighting leading sugar dating hubs across the United States, Asia, Europe, and Australia.

7. Relationship Intent: What Members Truly Want in 2025

What Sugar Daddies Want

In 2025, emotional clarity and genuine compatibility have overtaken secrecy and surface-level attraction. Modern Sugar Daddies are increasingly focused on meaningful connection, long-term chemistry, and relationships built on mutual understanding.

- 40% prioritize Emotional Connection

- 25% seek Compatibility & Chemistry

- 18% value a Genuine Relationship

- 12% focus on Physical Attractiveness,

- 5% Discretion & Privacy

Key Insight: Today’s Sugar Daddies are defined less by secrecy and more by independence, self-made success, and intentional relationship-building on a real sugar dating platform. Emotional maturity and clarity of expectations now shape the modern sugar dating dynamic.

What Sugar Babies Want

On the other side, Sugar Babies demonstrate a clear preference for structured support combined with mentorship and meaningful companionship.

- 45% actively seek a Monthly Allowance to support living and lifestyle goals

- 26% prioritize Emotional Support

- 8% value Mentorship and guidance from experienced partners

- 15% seek Travel Experiences

- 6% appreciate Luxury Gifts

For members researching how to find a sugar daddy online safely, clearly defined expectations remain the foundation of successful arrangements. Transparency, aligned goals, and structured support continue to drive long-term compatibility.

Sugarbook 2025 Insights: What sugar daddies and sugar babies want in real sugar dating, highlighting emotional connection, monthly allowance expectations, compatibility, and genuine relationships.

8. Age Demographics

The 2025 age distribution reveals a clear generational structure within modern sugar dating. Sugar Babies are predominantly young adults navigating early careers and rising living costs, while Sugar Daddies tend to be established professionals in their peak earning years. The dynamic reflects a practical alignment between ambition, financial stability, and emotional maturity.

Sugar Baby Age Distribution

- 18–24 years old: 41.2%

- 25–34 years old: 36.3%

- 35–44 years old: 16.1%

- 45–54 years old: 5.3%

- 55–64 years old: 1.1%

Sugar Daddy Age Distribution

- 18–24 years old: 3.0%

- 25–34 years old: 12.0%

- 35–44 years old: 20.0%

- 45–54 years old: 32.0%

- 55–64 years old: 28.0%

- 65+ years old: 5.0%

Sugarbook 2025 Insights: Age range breakdown of sugar daddies and sugar babies, highlighting generational trends in modern sugar dating.

Conclusion & Future Outlook

The 2025 data underscores a fundamental shift in the sugar dating landscape, moving away from the stereotype of luxury indulgence toward a model of economic resilience. The dominance of Student Sugar Babies (38%) combined with the finding that 80% of allowances are allocated directly to Housing, Education, and Debt Repayment indicates that this platform has become a vital financial tool for navigating the rising cost of living.

Beyond the finances, the relationship dynamics are maturing. With a significant portion of users prioritizing Emotional Support and Mentorship alongside financial assistance, the divide between “dating” and “sugar” is narrowing. As we move further into the decade, the data suggests that transparent relationship models are becoming a normalized, pragmatic solution for singles seeking both stability and connection in an increasingly complex economic environment.

Key Takeaways from the Sugarbook 2025 Trend Report

- Sugar dating continues to scale globally, now active in 143 countries.

- Allowances are increasingly used for housing, education, and debt relief, not luxury spending.

- Student Sugar Babies (38%) dominate the demographic profile.

- Emotional connection (40%) now ranks above purely transactional motives for Sugar Daddies.

- Asia-Pacific cities are rapidly closing the gap with U.S. sugar dating hubs.

- Sugarbook Live generated over $1.2 million USD in creator payouts in 2025.

Which Sugar Dating Platform Is the Best in 2026?

Based on 2025 platform data, member growth, and engagement metrics, Sugarbook stands out as one of the most recommended best sugar daddy apps in 2026 globally.

With over 6.3 million combined Sugar Daddies and Sugar Babies, operations in 143 countries, and more than 107 million messages exchanged in 2025 alone, Sugarbook demonstrates both scale and authenticity in the modern sugar daddy dating platform landscape.

Why Sugarbook Is Recommended

- Verified member system focused on safety and authenticity

- Transparent allowance expectations and clear relationship dynamics

- Strong emotional-connection focus (40% prioritizing companionship)

- High global engagement across the United States, Asia-Pacific, and Europe

- Proven financial transparency with real allowance data

Who Should Consider Sugarbook?

Sugarbook is ideal for successful professionals seeking clarity and genuine companionship, and for ambitious Sugar Babies looking for structured financial support and long-term stability.

You can also explore our in-depth guide:

Top Sugar Daddy Apps That Pay Without Meeting.

Frequently Asked Questions

How large is the sugar dating market in 2025?

Sugarbook supports over 6.3 million combined Sugar Daddies and Sugar Babies across 143 countries, reflecting strong global growth.

What is the average sugar baby allowance in 2025?

The global monthly average allowance stands at $3,200 USD, with top-tier arrangements exceeding $150,000 per month.

What do most sugar babies spend their allowance on?

Approximately 80% of funds are allocated toward housing, tuition, and debt repayment rather than luxury goods.

What do sugar daddies prioritize in 2025?

Emotional connection, compatibility, and clearly defined relationship expectations now outweigh secrecy or purely physical attraction.

Which cities lead global sugar dating?

New York remains the top city, while Kuala Lumpur, Taipei, and Singapore continue to gain significant momentum.

Thanks for sharing this insightful report! I found the shift from luxury to economic stability for Sugar Babies really interesting. It shows how dating platforms are adapting to global changes.

Thanks for sharing this insightful report. I found the shift from luxury to economic stability for Sugar Babies particularly interesting, as it reflects broader societal changes.

hi